The rise of green bonds and sustainable finance

The rise of green bonds and sustainable finance represents a crucial shift towards environmentally responsible investments, offering competitive returns while supporting projects that positively impact the environment and society.

The rise of green bonds and sustainable finance is creating new opportunities for investors and businesses alike. Have you considered how these innovative options could impact your financial decisions?

Understanding green bonds

Understanding green bonds is essential for grasping the evolution of sustainable finance. These investment tools are designed to fund projects that benefit the environment, contributing to a more sustainable future. But how do they work and why are they gaining popularity?

What Are Green Bonds?

Green bonds are fixed-income securities issued by governments, financial institutions, and corporations to raise capital for projects with environmental benefits. These projects can include renewable energy, energy efficiency, and sustainable waste management. Investors are encouraged to support such initiatives, often motivated by the potential for financial returns alongside ecological impact.

Benefits of Green Bonds

- Positive environmental impacts

- Increased investor interest

- Diversification for portfolios

- Potential for lower financing costs

Many investors appreciate that by purchasing green bonds, they are directly supporting important environmental causes. This lifestyle choice tends to align with the values of socially responsible investing. Furthermore, as the demand for these bonds grows, more companies are recognizing the long-term financial advantages of going green.

One primary advantage of green bonds is their ability to attract a new wave of investors, particularly millennials and environmentally conscious individuals. They are not just investing in financial returns but also in a better future. This shift in investment strategies can lead to substantial funds being directed into areas that genuinely require support for ecological advancement.

Challenges to Consider

Despite their benefits, there are challenges that investors must keep in mind. The lack of a universal standard for what qualifies as a green project can lead to confusion. Furthermore, not all projects financed through these bonds are equally impactful, which makes it important for investors to research thoroughly.

In conclusion, understanding the nuances of green bonds opens up opportunities for investors looking to make a difference while generating returns. The ongoing growth within this sector reflects a broader shift towards sustainability in finance and investment practices.

The role of sustainable finance

The role of sustainable finance is vital in today’s economy as it promotes investments that support environmental and social wellbeing. This concept goes beyond just making a profit; it integrates values that take our planet and communities into account while aiming for financial returns.

What is Sustainable Finance?

Sustainable finance refers to investments that consider environmental, social, and governance (ESG) criteria. Investors are increasingly interested in funds that do not harm the environment. They want to put their money into projects that positively impact society. By focusing on these factors, sustainable finance aims to create long-lasting benefits.

Key Components of Sustainable Finance

- Investment in renewable energy sources

- Promotion of energy efficiency projects

- Support for social equality initiatives

- Mitigation of climate change effects

Investors want to see their money contribute to a better future. For instance, many choose to finance green projects that help reduce carbon emissions. This is not only about doing good; it also aligns with the growing demand for transparency and responsibility in investing.

As we see more investors showing interest in sustainable finance, the financial sector is adapting. Financial institutions are developing new products that satisfy this growing demand. They are offering green bonds and sustainable funds that allow individuals and organizations to invest in environmentally responsible initiatives.

Benefits of Sustainable Finance

Choosing to invest sustainably can have numerous benefits. These include building a resilient economy, increasing shareholder engagement, and lowering risks associated with environmental issues. Additionally, it fosters innovation as companies seek sustainable solutions to attract investment.

By understanding the role of sustainable finance, investors can make more informed decisions. This approach not only supports their financial goals but also contributes to a healthier planet. Engaging in sustainable finance empowers investors to drive change.

Key benefits of investing in green bonds

Investing in green bonds comes with several key benefits that appeal to environmentally conscious investors. These investments not only aim to yield returns but also contribute positively to various environmental initiatives.

Environmental Benefits

One of the most significant advantages of investing in green bonds is their direct contribution to environmental protection. Funds raised through these bonds are typically allocated to renewable energy projects, energy efficiency upgrades, and other sustainable initiatives. This means that every dollar invested helps reduce carbon emissions and promotes a healthier planet.

Financial Returns

Investors are often concerned about the financial performance of their investments. Fortunately, green bonds have shown competitive returns, sometimes even outperforming traditional bonds. As the global economy shifts towards sustainability, many green projects are becoming increasingly profitable. This trend is likely to continue as regulations and societal expectations evolve regarding environmental responsibility.

- Potential for strong financial returns

- Tax incentives in some regions

- Low correlation with traditional financial markets

- Boosted portfolio diversification

Investing in green bonds also offers tax benefits in certain jurisdictions. Governments may provide tax incentives or credits to encourage investment in sustainable projects, adding additional appeal to investors looking for favorable financial terms.

Enhanced portfolio diversification is another crucial benefit. Because green bonds may not closely track traditional bond markets, they can help stabilize an investment portfolio during times of economic uncertainty.

Positive Social Impact

Beyond the financial aspects, investing in green bonds allows investors to align their investments with their values. By supporting projects that foster social equity and environmental protection, investors can contribute to a more sustainable future for everyone.

In summary, the appealing combination of environmental benefits, potential for strong financial returns, tax incentives, and the chance to create a positive social impact makes green bonds an attractive option for modern investors.

Challenges in the green bond market

The green bond market has grown rapidly, but it also faces several challenges that can affect its effectiveness and appeal. Understanding these challenges is crucial for investors looking to navigate this evolving landscape.

Market Standards

One significant hurdle in the green bond market is the lack of standardized definitions and criteria. Different issuers may label their bonds as “green” without consistent guidelines, which creates confusion for investors. Without clear standards, it can be difficult to determine which projects genuinely meet environmental goals. This inconsistency can lead to concerns about greenwashing, where companies claim sustainability without delivering on their promises.

Transparency and Reporting

Another challenge is the varying levels of transparency among issuers. Investors want clarity regarding how proceeds from green bonds are used and the environmental impact of funded projects. Insufficient or inconsistent reporting can erode trust in the market. Improved communication about the use of funds and results is essential for maintaining investor confidence in the green bond market.

- Lack of standardized definitions for green projects

- Concerns over greenwashing practices

- Insufficient transparency from issuers

- Inconsistent reporting on project outcomes

Additionally, many investors still see green bonds as niche investments, limiting their potential market. This perception can make it challenging for issuers to attract a broader range of investors. As demand for sustainable investments grows, it is crucial to address these challenges to unlock the full potential of green bonds.

The evolving regulatory landscape poses another set of challenges. Regulations related to green bonds can vary significantly across regions, leading to uncertainties for issuers and investors alike. Navigating these laws can be complex, often requiring detailed knowledge of multiple frameworks.

Economic Factors

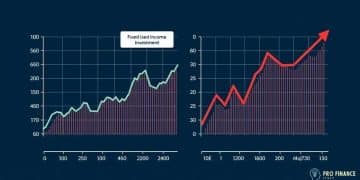

Lastly, economic factors such as interest rates and market conditions can impact the attractiveness of green bonds. In a rising interest rate environment, investors may prefer traditional bonds with guaranteed returns, making it difficult for green bonds to compete. Economic downturns can also shift priorities away from sustainable investing, as immediate financial concerns take precedence.

Future trends in sustainable finance

Future trends in sustainable finance are shaping how investors and companies approach their financial strategies. As awareness of environmental issues grows, the demand for sustainable financial products is expected to increase significantly.

Increased Regulatory Support

One notable trend is the increase in regulations promoting sustainability. Governments worldwide are implementing frameworks that encourage sustainable investing. These regulations aim to standardize definitions and reporting within the market, helping to reduce confusion for investors and creating a more transparent investment landscape.

Technological Innovations

Technological advancements are also playing a crucial role in the future of sustainable finance. The rise of fintech solutions is making it easier for investors to access green products. Technologies such as blockchain are improving the transparency and traceability of funds used in sustainable projects, addressing concerns about where money is directed.

- Growth of digital investment platforms

- Use of AI for risk assessment

- Blockchain for transparency

- Mobile apps for sustainable investment tracking

Investors can expect to see more accessible tools that help track the impact of their investments. As the market becomes more digitized, more people will have opportunities to participate in sustainable finance.

Focus on Longevity and Resilience

Another trend is the focus on longevity and resilience in investments. Investors are putting their money into projects that not only deliver immediate financial returns but also positively impact the environment and society over the long term. This shift aligns with the growing understanding that sustainable practices can lead to more robust economic systems.

The blending of environmental, social, and governance (ESG) criteria into traditional investing is becoming standard practice. As more investors recognize the importance of sustainability, funds that prioritize these factors are expected to gain traction.

Growing Public Awareness

Lastly, public awareness and demand for transparency are growing. Investors, especially younger generations, are increasingly holding companies accountable for their environmental and social practices. They want to know how their investments impact the world and are likely to choose brands that align with their values.

This shift will further drive the demand for sustainable finance as companies adapt to meet the expectations of socially conscious investors. The future of finance is bright and green, paving the way for a more sustainable economic landscape.

FAQ – Frequently Asked Questions About Green Bonds and Sustainable Finance

What are green bonds?

Green bonds are fixed-income securities issued to raise funds for projects with environmental benefits, such as renewable energy or energy efficiency.

How do green bonds provide financial returns?

Green bonds typically offer competitive financial returns, similar to traditional bonds, while also contributing to sustainable initiatives.

What are the main challenges of the green bond market?

Challenges include a lack of standardization, transparency issues, and concerns about greenwashing, which can erode investor confidence.

What is the future of sustainable finance?

The future of sustainable finance is bright, with increasing regulatory support, technological advancements, and growing public awareness driving demand for green investments.