Mortgage rates 2025 outlook: what to expect with 6–7%

Mortgage rates in 2025 are expected to range between 6% and 7%. They’ll be influenced by economic growth, inflation, and the Federal Reserve’s policies. It’s essential for buyers to stay informed and prepared.

Are you curious about the mortgage rates 2025 outlook? With predictions hovering around 6–7%, it’s crucial to understand how these changes could impact your finances. Let’s explore what this means for you.

Staying informed can help you make better decisions. This is for your financial future. Understanding current trends is essential for anyone considering buying a home.

Current trends in mortgage rates

Understanding the current trends in mortgage rates is essential. It is for anyone considering buying a home in 2025. Rates have been fluctuating, and several factors contribute to these changes.

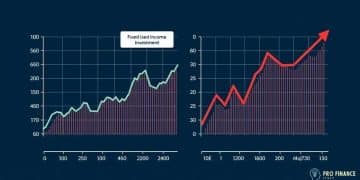

One major element influencing mortgage rates today is inflation. When inflation rises, lenders often increase rates to compensate. A strong economy can lead to higher rates.

Many buyers are exploring options like adjustable-rate mortgages (ARMs). This can be beneficial in a high-rate environment. It’s essential to understand the potential risks, though.

Factors Driving Mortgage Rates

One major element influencing mortgage rates today is inflation. When inflation rises, lenders often increase rates to compensate. A strong economy may also lead to higher rates.

Monitoring these trends can help you predict future rate movements. It’s important to keep an eye on Federal Reserve decisions. Economic indicators and housing market trends also play a role.

Many buyers are exploring options like adjustable-rate mortgages (ARMs). It allows homeowners to save on monthly payments initially. However, it’s essential to understand the risks as rates can adjust over time.

What to Watch For in 2025

You should keep an eye on Federal Reserve decisions. Their policy can significantly impact mortgage rates. You should also watch economic indicators.

Keep an eye on job reports and GDP growth. Also, be aware of housing market trends. Changes in supply and demand affect rates as well.

It’s essential to understand the pros and cons of different loan types. An informed approach can lead to better long-term savings. You should also consider the overall cost of borrowing.

Factors influencing mortgage rates in 2025

Several factors influencing mortgage rates in 2025 are essential to understand. These factors can affect not only the interest rates but also your overall borrowing experience. You need to understand these to navigate the housing market.

The overall health of the economy is a significant determinant. A booming economy can push rates higher. Conversely, during economic downturns, rates may drop as lenders adjust to lower demand.

Another crucial aspect is the actions of the Federal Reserve. Their decisions on interest rates influence how much it costs for lenders to borrow money. When the Fed raises rates, mortgage rates often follow suit.

Economic Conditions

The overall health of the economy is a significant determinant. When the economy is booming, demand for loans increases. This can push rates higher.

Job growth and consumer spending can signal economic strength. This can lead to potential rate hikes. Rising prices also typically spur interest rates.

Another crucial aspect is the actions of the Federal Reserve. When the Fed raises rates, mortgage rates often follow suit. Keeping an eye on the Fed’s moves will be vital.

Housing Market Dynamics

The balance between supply and demand plays a key role. If there’s a limited supply of homes, prices may rise. This can lead to higher mortgage rates.

Conversely, a surplus of homes for sale can result in lower rates. This is done to entice buyers. Understanding these shifts can give you an edge.

Shifting demographics may also influence demand. As more young people look for homes, the increased competition can impact prices and interest rates. Staying informed is essential.

Impact of inflation on mortgage rates

The impact of inflation on mortgage rates is significant. Rising prices can lead to higher borrowing costs for homebuyers. Lenders often raise interest rates to protect their profits.

When inflation is high, the purchasing power of money decreases. Lenders pass on increased costs to borrowers through higher rates. This means homebuyers may pay more.

The Federal Reserve often responds to rising inflation. If they increase the federal funds rate, this can impact mortgage rates as well. Keeping an eye on the Fed is key.

How Inflation Affects Lenders

When inflation is high, the purchasing power of money decreases. Lenders face increased costs. They pass these on to borrowers through higher rates.

As a result, potential homebuyers may find themselves paying more to finance a mortgage. Monitoring inflation trends is essential. It can help you anticipate changes in mortgage rates.

It’s also important to consider how inflation can shape economic policies. The Federal Reserve often responds to rising inflation. This can trickle down and impact mortgage rates.

Strategies in an Inflated Market

For borrowers facing potential rate hikes, locking in a mortgage at a lower rate can be wise. Many lenders offer options to secure rates upfront. This minimizes future risks.

Additionally, adjustable-rate mortgages (ARMs) may appeal to some. They often start with lower rates. This can be beneficial in a high-inflation environment.

However, rates can rise after an initial period. This is an important consideration. It is important to weigh the pros and cons of this option.

Strategies to secure better mortgage rates

Finding strategies to secure better mortgage rates can make a significant difference. With predicted rates around 6-7%, it’s essential to know how to navigate this. Improving your credit score is a key first step.

Your credit score plays a crucial role. A higher score can lead to lower rates. Focus on paying down debts and making payments on time.

Also, your debt-to-income (DTI) ratio is important. Lenders prefer a lower DTI. Consider reducing your debts to improve your chances of securing a better rate.

Improve Your Credit Score

Your credit score plays a crucial role in determining your interest rate. A higher score can lead to lower rates. Focus on paying down debts.

Make payments on time. Avoid new credit inquiries before applying for a mortgage. These small changes can have a big impact.

In addition, your debt-to-income (DTI) ratio is important. Lenders prefer a lower DTI. Consider reducing your debts to improve your chances.

Shop Around for Lenders

Don’t settle for the first offer you receive. Take the time to compare different lenders and their rates. Each lender has different criteria, which can lead to different offers.

Consider seeking pre-approval from multiple lenders. This not only gives you an idea of what rates to expect. It also makes you a more attractive buyer.

You can also look for lenders who offer competitive fixed rates. This can give you an edge in the market. It is important to be prepared.

Consider Different Loan Types

Exploring different types of mortgages can also lead to better deals. Fixed-rate mortgages offer stability. Adjustable-rate mortgages (ARMs) may provide lower initial rates.

You should understand the pros and cons of each option. This will help you choose what aligns best with your financial situation. It is important to find the right fit.

Finally, don’t overlook the importance of negotiating. Simply asking for a better rate or terms can yield surprising results. Be prepared to share your research and competing offers.

Future predictions for mortgage market

The future predictions for the mortgage market are crucial. Trends indicate that rates may stabilize around 6% to 7%. This is influenced by several economic factors.

As the economy continues to recover, housing demand is expected to remain robust. A growing job market leads to increased consumer confidence. This can drive more people to seek home financing.

It’s also worth noting that the Federal Reserve’s policies will significantly impact the mortgage landscape. If the Fed continues raising interest rates, we could see mortgage rates rise as a result.

Economic Growth and Housing Demand

As the economy continues to recover, housing demand is expected to remain robust. A growing job market typically leads to increased consumer confidence. This can drive more people to seek home financing.

This demand may keep mortgage rates in the higher range. This is as lenders respond to competition. Understanding these dynamics can help buyers plan effectively.

Rising incomes can lead to more buyers entering the market. This, along with increased household formation, could boost demand. Inflation may still play a role, potentially pushing rates upward.

Technological Innovation in Lending

The mortgage industry is evolving with technology. Many lenders are implementing digital tools. This is to streamline the application process.

This shift can lead to more competitive rates. This is as lenders seek to attract a tech-savvy clientele. Digital applications may result in faster approvals.

This can also lead to a better customer experience. Alternative lending options may also become more popular. Peer-to-peer lending could emerge as a viable option.

FAQ – Frequently Asked Questions about Mortgage Rates in 2025

What are the expected mortgage rates for 2025?

Mortgage rates are predicted to be around 6% to 7% in 2025 based on current economic trends.

How does inflation impact mortgage rates?

Inflation generally leads to higher mortgage rates as lenders adjust to maintain their profit margins.

What can I do to secure a better mortgage rate?

Improving your credit score, shopping around for lenders, and considering different loan types can help you secure a better rate.

Why is it important to monitor the Federal Reserve’s policies?

The Federal Reserve’s interest rate decisions can significantly influence mortgage rates, so staying updated can help you make informed borrowing decisions.