Impact of rising global debt on financial stability

The impact of rising global debt on financial stability includes increased financial risk, higher interest rates, inflation pressures, and significant consequences for both local and global economies.

Impact of rising global debt on financial stability raises important questions about the state of our economies today. How does increasing debt influence your everyday financial decisions and the market you operate in? Let’s explore this issue together.

Understanding global debt levels

Understanding global debt levels is crucial for grasping the implications it has on our economies. The rise in debt can lead to significant challenges, affecting everything from national budgets to individual financial security.

What Contributes to Global Debt?

Several factors contribute to the increasing levels of debt worldwide. First, wars and conflicts often force governments to borrow heavily. Additionally, economic crises can compel nations to increase their borrowing as they attempt to stimulate growth.

Effects of High Debt Levels

When countries have high levels of debt, they face various challenges:

- High debt servicing costs can divert funds from essential services.

- Confidence in the economy may decline, making it harder to attract investment.

- Rising debt could lead to inflation or currency depreciation.

These effects highlight the importance of managing debt effectively. Understanding how nations accumulate and handle debt levels is essential for both policymakers and citizens.

Moreover, it’s important to consider how trends in borrowing can influence global markets. For instance, if major economies increase their debt significantly, it can impact international interest rates and commodity prices. In this interconnected world, we all feel the ripple effects.

National vs. Global Debt

While it’s easy to focus on national debt, global debt levels matter just as much. A rise in one country’s debt can trigger concerns in others, especially in developing economies, which are most vulnerable to fluctuations.

Furthermore, with the increasing integration of markets, decisions made in one region can have immediate impacts worldwide. Hence, a comprehensive understanding of global debt is not just academic; it’s a necessity for informed decisions and strategies.

As we investigate these debt dynamics, keep in mind the various stakeholders. Governments, international organizations, and private sectors all play a role in shaping debt trends and managing challenges.

Key factors driving debt growth

Several key factors are driving debt growth globally, making it vital to understand their impact on financial stability. Increased borrowing can be traced to various sources, influences, and events that shape economic circumstances.

Economic Conditions

Economic downturns lead to higher debt levels. When recessions occur, governments often increase spending to stimulate growth. This spending usually requires borrowing, which contributes to rising national debts.

Interest Rates

Another significant factor is the interest rates set by central banks. Lower interest rates make borrowing attractive. Individuals and governments may seize the opportunity to take loans for investment and consumption. As a result, low rates can drive up debt growth significantly.

- Businesses expand operations.

- Homeowners refinance or buy larger homes.

- Governments fund infrastructure projects.

On the other hand, as interest rates rise, the cost of servicing existing debt increases, adding strain on budgets and financial planning.

Consumer Confidence

Consumer confidence plays a crucial role in debt accumulation. When people feel optimistic about the economy, they are more likely to spend and borrow. This positive sentiment can lead to increased debts for households, as they may purchase larger items or invest in education.

Government Policies

Finally, government policies surrounding fiscal management can either curb or encourage debt growth. Policies that promote social programs without addressing funding lead to a rise in debt. Similarly, tax cuts without offsetting revenues can result in increased borrowing.

Monitoring these factors is essential for understanding how they interact and contribute to the ongoing challenges of managing global debt levels. By grasping these influences, citizens and policymakers can make informed decisions to help stabilize economies.

Consequences of rising debt on economies

The consequences of rising debt on economies can be significant and far-reaching. Understanding these effects is essential for grasping the overall health of financial systems around the world.

Increased Financial Risk

Rising debt levels can lead to heightened financial risk for both governments and businesses. When debts increase, so do the chances of default. As countries borrow more, they may find it challenging to meet interest payments, which puts them at risk of financial instability.

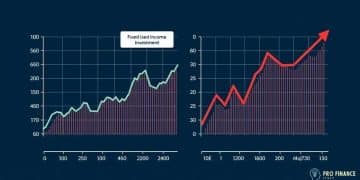

Impact on Interest Rates

As debt levels rise, interest rates may also be affected. Lenders might demand higher rates to compensate for the increased risk of lending to heavily indebted borrowers. Higher interest rates can limit access to capital for businesses and consumers, leading to a slowdown in economic growth.

Inflation Pressures

Inflation can also be a consequence of rising debt. When governments print more money to cover their debts, this can lead to an increase in prices for goods and services. Higher inflation reduces purchasing power for consumers, making it more difficult to afford daily necessities.

- Households may cut back on spending.

- Businesses may face lower demand.

- Investment in growth could decline.

In such scenarios, economies can spiral into downturns, creating a cycle of increasing debt and declining growth.

Global Implications

Moreover, the consequences of rising debt are not confined to individual countries. When one nation’s debt rises, it can have ripple effects globally. For example, if a major economy struggles with debt, it can impact trade relations, foreign investments, and exchange rates.

In addition, international markets can respond to these changes, leading to volatility and uncertainty. This interconnectedness means that understanding debt impacts is vital for global financial stability.

Strategies for managing debt

Managing debt effectively requires a combination of strategies and planning. Developing sound debt management practices can help individuals and governments navigate financial challenges.

Budgeting

One of the first steps in managing debt is creating a detailed budget. Knowing how much income is coming in and where it is going out is essential. A budget helps prioritize expenses and identify areas for potential savings.

Debt Consolidation

Debt consolidation can be a powerful strategy. By combining several high-interest debts into a single loan with a lower interest rate, individuals can save money over time. This approach simplifies payments and makes it easier to track overall debt.

- Lower monthly payments.

- Reduced interest costs.

- Streamlined payment schedules.

However, it is crucial to do thorough research before consolidating debt to avoid potential pitfalls.

Prioritizing Payments

Another effective strategy involves prioritizing payments. Focus on paying off high-interest debts first, as they can accumulate costs quickly. This method can significantly reduce overall debt and improve financial health.

Using the snowball method is another option. This involves paying off smaller debts first, which can provide quick wins and increase confidence in managing finances.

Seeking Professional Help

When debt becomes overwhelming, seeking professional help may be necessary. Financial advisors or credit counseling services can provide valuable insights and strategies tailored to individual situations. They can assist in creating personalized plans to tackle debt systematically.

Ultimately, effective management of debt requires a proactive approach. By employing these strategies and remaining vigilant about finances, individuals and governments can work towards achieving financial stability.

Future outlook on global financial stability

The future outlook on global financial stability is shaped by various factors, including economic trends and geopolitical events. As we look ahead, it’s essential to evaluate these elements to anticipate potential challenges and opportunities.

Economic Growth Projections

Projected economic growth plays a critical role in ensuring financial stability. If nations can maintain or improve their growth rates, they are more likely to manage their debts effectively. In contrast, a slowdown can increase debt burdens and strain resources.

Technological Advancements

Technology will also impact financial stability in the future. Innovations in financial technology (fintech) can enhance security and efficiency in transactions. However, rapid advancements can also lead to disruptions, requiring adaptability from financial institutions and governments.

- Blockchain technology for secure transactions.

- AI in predicting market trends.

- Digital currencies gaining acceptance.

These advancements can help create more resilient financial systems if managed properly.

Political and Social Factors

The political landscape shapes financial stability significantly. Changes in governance, trade policies, and international relations can create uncertainties that affect markets. Additionally, social factors like income inequality and population growth can impact economic dynamics.

Addressing social challenges will be crucial to achieving long-term financial stability. If not handled, these issues could lead to conflicts that disrupt economic progress.

Global Cooperation

In today’s interconnected world, global cooperation is more important than ever. With rising debt levels in many countries, international collaboration can foster stability. Countries must work together to address shared challenges, such as climate change and trade imbalances.

This collaborative approach could mitigate risks associated with global financial stability and lead to a more sustainable future.

FAQ – Questions about the impact of rising global debt on financial stability

What are the main consequences of rising global debt on economies?

Rising global debt can lead to increased financial risk, higher interest rates, inflation pressures, and potential economic downturns.

How can countries effectively manage their debt levels?

Countries can manage debt through strategies like budgeting, debt consolidation, prioritizing payments, and seeking professional financial advice.

What role does technological advancement play in financial stability?

Technological advancements improve financial systems’ efficiency and security, but rapid changes can also disrupt established practices.

Why is global cooperation important for financial stability?

Global cooperation helps address shared economic challenges and promotes stability by encouraging countries to work together in managing risks.