U.S. credit card delinquencies 2025: Rising challenges for consumers and businesses

U.S. credit card delinquencies 2025 are rising due to economic pressures such as inflation, increased interest rates, and stagnant wages. These shifts are significantly impacting consumers’ financial health while forcing businesses and financial institutions to rethink their strategies.

The landscape of personal debt is evolving rapidly, and both borrowers and lenders must prepare for an uncertain future. As we move deeper into 2025, the issue is no longer confined to struggling households, it has become a nationwide concern that touches every part of the economy.

The increase in delinquencies is raising questions about financial resilience, consumer spending habits, and whether current systems are adequate to handle the mounting pressure.

Current trends in credit card delinquencies

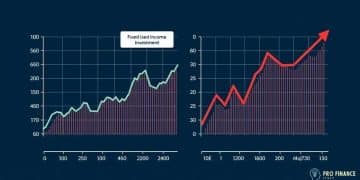

The current trends reveal a troubling reality. U.S. credit card delinquencies 2025 are not only climbing but also surpassing pre-pandemic levels. Unlike the temporary spikes observed during economic crises of the past, the current rise appears more sustained and rooted in structural financial challenges.

One of the most noticeable trends is the significant increase in delinquency rates across the country. More households are falling behind on their payments each month, creating ripple effects in credit markets.

Rising inflation has eroded purchasing power, while higher interest rates have increased the cost of carrying debt. Together, these factors make it harder for consumers to keep up with even minimum payments.

Another aspect driving this shift is the increased reliance on credit cards for daily expenses. Many families now use credit not just for emergencies or discretionary purchases but for groceries, utilities, and healthcare.

This reliance has led to an accumulation of debt that feels unsustainable, especially as wages fail to keep pace with the cost of living. These current patterns suggest that delinquencies are not merely cyclical but symptomatic of deeper economic imbalances. For both consumers and lenders, recognizing these trends is the first step toward finding solutions.

Increasing delinquency rates

The numbers behind U.S. credit card delinquencies 2025 paint a stark picture. Delinquency rates are rising faster than many analysts predicted, reflecting a combination of macroeconomic pressures and household-level decisions. The data show that millions of consumers are slipping from being current on their accounts to being thirty, sixty, or even ninety days past due.

Several factors explain why this is happening. Inflation continues to drive up the cost of essentials, meaning people spend more without necessarily earning more.

Interest rates, raised as part of monetary policy to control inflation, have made it significantly harder for borrowers to manage variable-rate credit card debt. At the same time, economic uncertainty, ranging from housing market pressures to job insecurity, has heightened consumer vulnerability.

With more households unable to keep up, financial institutions are being forced to address growing risks. Lenders are already reassessing underwriting standards, while some are introducing stricter monitoring of high-risk accounts. Yet the sheer scale of delinquencies indicates that systemic challenges remain unresolved.

Key factors behind the rise

The key factors driving U.S. credit card delinquencies 2025 form a web of interconnected issues. Higher living costs are the most visible problem, but they cannot be separated from increased credit card usage, rising interest rates, and broader economic uncertainty.

As the cost of housing, energy, and food increases, households often turn to credit cards to bridge gaps in their budgets. This strategy may work temporarily, but over time it leads to mounting balances that become increasingly difficult to pay off.

Rising interest rates worsen the situation by adding to the burden of monthly payments, leaving consumers with fewer resources to cover principal amounts. Economic uncertainties further exacerbate these pressures. Job market volatility, combined with concerns about future economic downturns, creates instability that discourages long-term financial planning.

Many consumers, caught between stagnant incomes and rising expenses, feel forced into short-term survival strategies that inevitably lead to delinquency. Taken together, these factors show that the problem is not just about individual behavior but about structural economic conditions that demand wider attention.

Factors driving delinquencies in 2025

The drivers behind U.S. credit card delinquencies 2025 go beyond numbers, they reveal how deeply personal finance is shaped by broader economic realities. Inflation is one of the most persistent issues. As everyday goods become more expensive, household budgets shrink, and families are left with little choice but to rely on credit cards.

Rising interest rates also play a pivotal role. For consumers carrying balances, the increase in minimum payments can be overwhelming. Even a small percentage hike adds hundreds of dollars annually to the average household’s credit card bill. This makes it far more likely for individuals to miss payments or fall into delinquency.

Changes in consumer behavior are also contributing. Many households have grown accustomed to using credit cards not only for emergencies but also as a standard financial tool.

The lack of savings across large portions of the population has compounded this reliance. With minimal financial cushions, even small disruptions, such as unexpected medical bills, can trigger missed payments.

Lastly, financial literacy remains an underlying challenge. Many individuals simply do not fully understand how interest compounds, how quickly debt can spiral, or the long-term consequences of missing payments. Without proper guidance, consumers may inadvertently worsen their financial situations.

Impact on consumers’ financial health

The rise of U.S. credit card delinquencies 2025 is already leaving a noticeable mark on consumer well-being. The immediate consequence is stress. Millions of Americans are living with the constant anxiety of missed payments, harassing phone calls from creditors, and the looming fear of damaged credit scores.

When delinquencies escalate, credit scores inevitably decline. A lower score makes it harder for consumers to access affordable credit in the future, creating a vicious cycle where borrowing becomes more expensive. This directly impacts opportunities such as securing a mortgage, buying a car, or even renting an apartment.

In the long term, the financial fallout can be devastating. Consumers burdened with delinquent credit cards may struggle to achieve significant milestones such as homeownership or retirement savings.

Insurance premiums may increase, and employers in certain industries may even consider credit history when making hiring decisions. The ripple effects of these delinquencies extend beyond individuals.

When millions of people reduce their spending power, entire sectors of the economy, from retail to real estate, feel the consequences. This shows how personal finance issues can escalate into broader economic problems.

How businesses can adapt to changes

Businesses must adapt to the reality of rising U.S. credit card delinquencies 2025 if they wish to maintain stable customer relationships. One of the most important steps is understanding shifting consumer behavior. As more customers struggle with debt, businesses should anticipate changes in spending patterns and adjust their offerings accordingly.

Flexible payment options can be part of the solution. By introducing installment plans, extended payment deadlines, or hardship programs, businesses can help customers manage their financial obligations while reducing default risks. Such strategies also build customer loyalty by demonstrating empathy and support during difficult times.

Another critical adaptation is promoting financial education. Companies can organize workshops, create online resources, or partner with financial experts to help customers better understand credit management and budgeting. Empowering consumers in this way not only supports their financial health but also strengthens brand reputation.

Technology also plays a vital role in adaptation. By investing in mobile payment platforms and AI-powered financial tools, businesses can streamline payment processes and encourage more responsible spending. Digital solutions that provide real-time reminders, personalized repayment suggestions, or automated budgeting can significantly reduce the risk of delinquency.

Future outlook for credit card delinquencies

The future outlook for U.S. credit card delinquencies 2025 is concerning but also offers opportunities for change. Analysts widely agree that delinquency rates may continue to rise if current economic pressures persist. Inflation is unlikely to ease dramatically in the near term, and interest rates remain elevated as central banks attempt to stabilize the economy.

Government policies will also influence the trajectory of delinquency rates. If interest rates increase further, borrowing costs will rise sharply, potentially pushing more consumers into delinquency. Conversely, relief measures or targeted financial programs could soften the blow.

Shifts in consumer behavior will be equally important. A growing number of Americans are turning toward budgeting tools, savings accounts, and financial literacy resources. This change could eventually reduce delinquency rates if it becomes widespread. However, the pace of adoption will determine how much impact these positive behaviors have in countering economic pressures.

Technology-driven financial solutions are expected to play a major role. Apps that track spending, provide financial coaching, or automate savings can help consumers stay on top of their finances. Financial institutions using AI to predict at-risk borrowers and intervene early may also reduce defaults.

The rise of U.S. credit card delinquencies 2025 highlights both the vulnerabilities of consumers and the responsibilities of businesses and financial institutions. With inflation, rising interest rates, and greater reliance on credit cards, millions of Americans are facing financial challenges that cannot be ignored.

The consequences extend beyond individual households, affecting credit markets, business revenues, and the overall economy. But solutions do exist. By offering flexible payment options, promoting financial literacy, and embracing technological innovation, businesses can support consumers in navigating these turbulent times.

Ultimately, tackling the problem of U.S. credit card delinquencies 2025 requires collective action. Consumers must become more financially informed, businesses must provide supportive tools, and policymakers must create environments that promote stability. Only then can the cycle of delinquencies be broken and replaced with healthier financial habits for the future.

FAQ – Frequently Asked Questions about Credit Card Delinquencies

What are the main reasons for the rise in credit card delinquencies?

The main reasons include economic factors like inflation, increasing costs of living, and rising interest rates that make it harder for consumers to manage their debt.

How can consumers avoid falling into delinquency?

Consumers can stay on top of their finances by budgeting carefully, understanding their credit obligations, and seeking financial education resources.

What strategies can businesses implement to adapt to increasing delinquencies?

Businesses can offer flexible payment options, enhance financial literacy programs, and utilize technology to make payments easier for their customers.

What is the future outlook for credit card delinquencies?

The forecast suggests that delinquency rates may continue to rise, but increased consumer awareness and adaptive business strategies can help mitigate some of these challenges.