Jackson Hole 2025 Fed framework reboot: what it means for the economy

The Jackson Hole 2025 Fed framework reboot aims to reshape monetary policy. This will balance inflation control with employment growth, impacting market dynamics.

The reboot is a critical moment for investors and policymakers. It will influence economic strategies and potentially reshape market expectations in unexpected ways.

This reboot will have significant consequences. Understanding its impact can help you prepare for shifts in economic trends and financial planning.

Understanding the Jackson Hole Economic Symposium

The Jackson Hole Economic Symposium is an important annual event. Central bankers and economists gather to discuss major economic issues and challenges.

This gathering shapes policies that influence global markets. Each year, the symposium sets the stage for future economic decisions.

At this event, key topics like inflation and economic growth are addressed. These discussions help investors make informed decisions about market strategies.

The Importance of the Symposium

During the symposium, key themes emerge that guide monetary policy. Leaders express views on topics like inflation, economic growth, and employment.

Understanding these topics is essential for staying ahead of economic trends. This helps investors make well-informed financial decisions based on upcoming changes.

The symposium’s impact stretches far beyond the event itself. It sets the tone for policy changes that will affect global markets for years.

Key Discussions at the Symposium

The symposium covers important economic topics. It addresses inflation, labor markets, and global economic outlooks.

Monetary policy strategies are also a key focus of these discussions. The symposium provides valuable insights from influential figures in economics.

Attendees gain clarity on potential economic trends and government responses. These discussions shape market expectations and investment strategies.

Key changes in the Fed’s framework

The Federal Reserve has made significant changes to its monetary policy framework. These changes aim to address new economic challenges and maintain financial stability.

Understanding these adjustments is essential for anticipating future market behavior. The Fed’s evolving framework will guide economic conditions in the coming years.

The new approaches focus on balancing inflation control with employment. This shift influences both short-term and long-term economic outcomes.

New Approaches to Inflation

The Fed’s new approach allows inflation to exceed its target temporarily. This aims to support economic growth before tightening monetary policies.

Inflation is no longer solely controlled by aggressive measures. The Fed seeks a more flexible approach that allows for growth and stability.

This shift is a key factor in shaping future inflation trends. The Fed’s approach will be monitored closely by investors and policymakers.

Focus on Employment

The Fed’s framework now prioritizes achieving maximum employment. This focus aims to balance stable prices with sustainable job growth.

By focusing on employment, the Fed hopes to create a more inclusive economy. This may lead to extended periods of lower interest rates to support job growth.

This shift is aimed at promoting job creation while managing inflation. It reflects a broader approach to economic stability and growth.

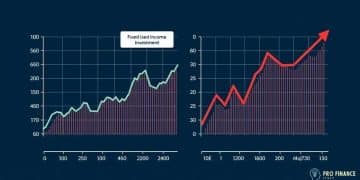

Potential impacts on inflation and employment

The relationship between the Fed’s policies and inflation is crucial. As the Fed adjusts its framework, inflation rates may rise or fall depending on policy decisions.

The Fed’s focus on employment could lead to job growth. However, rapid inflation may prompt the Fed to adjust monetary policy, impacting employment levels.

Balancing inflation control with employment goals is a delicate task. Policies that aim to improve one area may inadvertently affect the other.

Inflation Dynamics

Inflation rates may rise as the Fed adjusts its policies. The Fed’s approach allows inflation to exceed its target temporarily to foster economic growth.

However, unchecked inflation could lead to persistent price increases. Monitoring inflation carefully is critical to avoid long-term economic instability.

The Fed must balance short-term growth with long-term price stability. This dynamic will shape inflationary trends over the next few years.

Employment Trends

The Fed’s focus on employment aims to reduce unemployment rates. Policies supporting businesses may create more job opportunities, driving economic growth.

However, if inflation rises too quickly, the Fed may raise interest rates. This could slow down job creation and impact the labor market.

A dynamic labor market can boost consumer spending, but rising inflation can hinder purchasing power. The balance between employment and inflation is critical for economic stability.

Market reactions to policy shifts

Market reactions to changes in Fed policy can be swift. Investors closely monitor policy announcements, adjusting their positions based on perceived risks and opportunities.

Stock and bond markets often react immediately to Fed announcements. Rising interest rates typically lead to a decrease in stock prices as borrowing costs increase.

Long-term market implications are just as important. Interest rate changes affect consumer spending and investment, influencing sectors like housing and technology.

Immediate Market Responses

Stock and bond markets react quickly to Fed announcements. When interest rates rise, stock prices often fall due to increased borrowing costs.

Traders analyze the potential risks and rewards of Fed policy changes. Immediate reactions can set the tone for market sentiment in the days that follow.

Understanding market reactions helps investors adjust their strategies. This proactive approach can mitigate risks during periods of economic uncertainty.

Long-term Market Implications

Sustained interest rate changes influence consumer behavior and business investments. Higher rates typically slow down expansion plans, while lower rates stimulate growth.

The impact of policy changes also extends to sector-specific markets. Real estate, technology, and commodities are often affected by Fed announcements.

Long-term implications of monetary policy shifts are significant. Businesses and investors must adjust strategies based on the direction of the economy.

Expert opinions on the future of monetary policy

Experts are weighing in on the future of monetary policy. Their opinions help shape expectations about upcoming economic changes and challenges.

Some economists advocate for a cautious approach, while others call for more aggressive actions. These differing views offer valuable insights into the Fed’s potential future moves.

Monitoring expert opinions helps investors prepare for policy shifts. These insights provide clarity on how the Fed will handle inflation and economic growth in the future.

Diverse Views on Rate Adjustments

Many economists are analyzing future rate changes. Some advocate for a cautious approach, while others recommend aggressive measures to control inflation.

The balance between controlling inflation and encouraging economic growth is delicate. The key is finding the right rate adjustments to ensure stability.

Listening to expert opinions can guide investment decisions. These insights help investors understand potential monetary policy outcomes.

Impacts on Inflation and Growth

Experts emphasize the need to balance inflation control with economic growth. A rapid increase in rates may slow growth, but it is necessary to manage inflation.

Growth forecasts vary depending on the Fed’s approach. The impact of monetary policy decisions will shape inflation and growth trends.

As inflation rises, it may negatively affect growth. Understanding expert opinions helps investors make informed choices based on anticipated economic conditions.

In conclusion, the landscape of monetary policy is evolving rapidly. The Federal Reserve’s recent framework changes are set to influence inflation and employment significantly.

Investors and economic stakeholders must pay close attention to expert opinions and market reactions to navigate this landscape effectively.

By understanding these dynamics, individuals, and businesses can make more informed decisions in the face of uncertainty.

FAQ – Frequently Asked Questions about Monetary Policy and Market Reactions

What is the role of the Federal Reserve in monetary policy?

The Federal Reserve regulates the money supply, manages inflation, and aims to promote maximum employment through its monetary policies.

How do market reactions typically respond to Fed announcements?

Markets often react quickly to Fed announcements, with stock prices adjusting based on anticipated changes in interest rates and economic conditions.

Why is understanding inflation and employment important?

Inflation and employment are key indicators that influence economic health. Balancing them helps improve consumer confidence and economic growth.

What factors do experts consider regarding future monetary policy?

Experts analyze trends in inflation, employment data, and global economic conditions to predict future decisions made by the Federal Reserve.