How geopolitical tensions affect market volatility

Geopolitical tensions significantly impact market volatility, as investors must monitor events closely to adapt strategies, leverage safe-haven assets, and make informed decisions amid changing economic landscapes.

How geopolitical tensions affect market volatility is a topic that even seasoned investors cannot ignore. With the world stage constantly shifting, have you noticed how these tensions shape our financial landscape? Let’s dive into this critical connection.

Understanding geopolitical tensions and their origins

Understanding geopolitical tensions is essential for anyone looking to navigate today’s complex financial landscape. These tensions often have deep historical roots, affecting the stability of markets across the globe. In this section, we will explore what geopolitical tensions are and how they originate.

What are geopolitical tensions?

Geopolitical tensions arise from conflicts between countries or regional powers over resources, territories, or ideologies. They can be triggered by various factors, including:

- Territorial disputes

- Economic competition

- Ethnic and religious conflicts

- Global power shifts

These factors can lead to strained diplomatic relations, trade wars, or even military conflicts, which ultimately affect global markets.

Origins of geopolitical tensions

The origins of geopolitical tensions are often complex and multi-faceted. Historical grievances play a significant role, as past events can shape current interactions and policies. Additionally, economic interests can inflame tensions, particularly when it comes to valuable resources like oil or water. For instance, countries that depend heavily on imports might find themselves negotiating aggressively during crises.

Another contributing element is cultural identity. In many regions, communities with distinct ethnic or religious identities may clash with those of a different background, causing political instability. Power dynamics can also shift, leading countries to assert dominance in their regions, sowing discord and resulting in political and social unrest.

Understanding these origins helps investors and analysts predict market movements. By keeping an eye on the underlying tensions, they can make informed decisions during volatile periods.

The interplay between these complex factors is crucial for grasping the full scope of geopolitical issues that can affect markets worldwide. Recognizing how historical context informs current tensions is vital for both investors and policymakers alike.

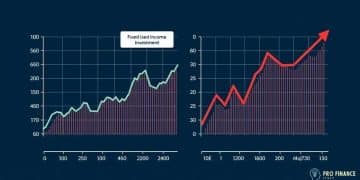

The relationship between geopolitics and market fluctuations

The relationship between geopolitics and market fluctuations is intricate and often unpredictable. Understandably, many investors are focused on how political events can sway market performance. A single geopolitical event can send shockwaves through financial systems, highlighting just how interconnected our world has become.

How do geopolitical events affect markets?

Major geopolitical events such as wars, treaties, or sanctions can lead to rapid changes in market conditions. For instance, when a country engages in military action, it can disrupt supply chains and affect commodity prices. This, in turn, leads to investor reactions that shift stock prices.

- Military conflicts often decrease investor confidence.

- Sanctions can create shortages of essential resources.

- Trade agreements may open up new market opportunities.

- Political instability can result in heightened caution among investors.

These dynamics show how intertwined politics and finance are. Investors must remain vigilant to these shifts to make informed decisions about their portfolios.

Investor strategies during geopolitical changes

Understanding these relationships allows investors to adapt their strategies effectively. For instance, during times of heightened tension, some may choose to invest in defensive stocks or commodities like gold and oil, which tend to perform better during uncertainty.

By contrasting various market reactions, investors can identify patterns and make educated choices. Awareness of global news and historical events can also aid in predicting how future developments may affect their investments.

A well-prepared investor will not only follow market trends but also stay informed about the geopolitical landscape. Engaging with reliable news sources can provide insight into emerging issues that could impact market stability.

Real-world examples of geopolitical crises impacting markets

Real-world examples of geopolitical crises provide valuable insights into how these events can impact markets. Historical occurrences reveal the deep connections between political events and economic outcomes. Understanding these examples can help investors recognize patterns that affect global markets.

Case Study: The Gulf War

The Gulf War in the early 1990s significantly affected oil prices and market stability. During the conflict, oil supplies were threatened, leading to an increase in prices. Investors reacted swiftly, and stock markets around the world experienced volatility as the situation unfolded.

- Oil prices surged due to uncertainty.

- Stock markets saw rapid declines as fears grew.

- Investors shifted focus to energy sectors.

This conflict highlights how a single geopolitical event can ripple through economies, affecting various sectors.

Case Study: The 2011 Arab Spring

The Arab Spring was a series of protests and uprisings in several Middle Eastern countries. These movements caused political instability and uncertainty that influenced regional and global markets. Countries like Egypt and Libya faced turmoil, which disrupted investments and led to significant market fluctuations.

As political instability increased, international investors hesitated to put money into these regions. The effects were felt worldwide, showcasing the interconnectedness of global markets.

Case Study: The Ukraine Crisis

In 2014, the Ukraine crisis unfolded, leading to Russia’s annexation of Crimea. This situation caused sanctions from the West against Russia, impacting not only Russian markets but also global energy prices. Investors reacted by adjusting their portfolios, uncertain about future energy security and potential economic fallout.

Many turned to safe-haven assets, like gold and U.S. Treasury bonds, as uncertainty grew. This crisis demonstrated how geopolitical tensions can lead to immediate and wide-ranging effects in the financial markets.

These examples underline the necessity for investors to stay informed about global events. Understanding past crises allows for better preparedness for future geopolitical situations that may arise.

Strategies for investors during geopolitical instability

During times of geopolitical instability, investors face unique challenges and opportunities. Developing effective strategies is essential for navigating uncertain markets. By being prepared, investors can protect their assets and potentially benefit from shifting market conditions.

Diversification of assets

One of the most critical strategies is asset diversification. By spreading investments across various sectors and geographies, investors can reduce risk. If one sector suffers due to geopolitical events, others may perform better, balancing the overall portfolio.

- Consider investing in different asset classes such as stocks, bonds, and commodities.

- Geographical diversification can help mitigate local risks.

- Invest in sectors that are less affected by geopolitical tensions, like healthcare or consumer staples.

Implementing a diversified strategy allows investors to shield themselves from sudden market declines caused by geopolitical events.

Focus on safe-haven assets

Investors often turn to safe-haven assets during turbulent times. These investments tend to hold their value or even appreciate during geopolitical crises. Common examples include gold, U.S. Treasuries, and certain currencies like the Swiss franc.

These assets provide security when investors are unsure about the economic outlook. By including safe-haven assets in their portfolios, investors can help protect against market volatility. This strategy can provide reassurance and stability amidst chaos.

Staying informed and agile

Being aware of global events and trends is critical. Investors should follow reliable news sources to stay updated on geopolitical developments. By being informed, they can respond quickly to changing conditions that may affect their investments.

Additionally, remaining agile allows investors to reallocate assets when necessary. They should be ready to make quick changes to their portfolios in response to geopolitical shifts. This adaptability can be a significant advantage during uncertain times.

Overall, implementing these strategies can enhance resilience during periods of geopolitical instability. By diversifying assets, focusing on safe havens, and staying informed, investors can navigate challenges more effectively.

Future trends: Anticipating market reactions to geopolitical events

Future trends in anticipating market reactions to geopolitical events indicate a growing need for investors and analysts to be proactive. As global interactions become more complex, understanding patterns can help in predicting how markets may react to unforeseen circumstances.

The role of technology

Technology plays a crucial role in forecasting market trends. Advanced analytics and data models can process vast amounts of information from social media, news outlets, and market reports. This data can reveal shifts in investor sentiment before they impact prices.

- Real-time data analysis helps identify emerging trends quickly.

- Artificial intelligence can predict potential market movements based on historical geopolitical events.

- Machine learning algorithms can enhance the accuracy of forecasts.

Employing such technologies allows investors to adapt quickly to sudden geopolitical changes.

Emerging markets and new alliances

As global politics evolve, emerging markets like Southeast Asia and Africa are becoming significant players. Monitoring developments in these regions can provide insights into potential market shifts. Changes in alliances among countries can also create new economic opportunities or risks.

Investors should focus on how these dynamics may reshuffle the global economic landscape. Recognizing which countries are forming new partnerships can help predict future resource allocations and market viability.

Globalization and local factors

While globalization connects markets, local factors still determine individual market reactions. Understanding how local politics influence global trends remains essential. For instance, a domestic policy change can drastically affect foreign investments and trade relationships, leading to market fluctuations.

This interconnectedness means that political events in one region can create ripple effects worldwide. Investors need to remain agile and informed about both global and local developments to make sound decisions.

By focusing on these future trends, investors can better anticipate market reactions to geopolitical events. Recognizing the impact of technology, emerging markets, and local factors will enhance their ability to navigate uncertain financial landscapes.

In conclusion, understanding how geopolitical tensions affect market volatility is crucial for investors. By recognizing real-world examples and implementing effective investment strategies, one can better navigate these uncertain times. Keeping an eye on technological advancements, emerging markets, and local factors will enhance the ability to anticipate market reactions. Staying informed is key to making sound investment decisions and capitalizing on opportunities amid geopolitical changes.

FAQ – Frequently Asked Questions about Geopolitical Tensions and Market Volatility

How do geopolitical tensions affect my investment portfolio?

Geopolitical tensions can lead to market volatility, causing changes in asset values. Being aware of these tensions helps investors make informed decisions.

What are safe-haven assets, and why should I consider them?

Safe-haven assets, like gold and U.S. Treasuries, typically retain or increase in value during times of geopolitical instability, providing security for your portfolio.

How can I stay informed about geopolitical events?

Following reliable news sources, subscribing to market analysis reports, and using financial news apps are great ways to stay updated on geopolitical events.

What strategies can I implement to manage risk during geopolitical crises?

Diversifying your investment portfolio, focusing on safe-haven assets, and leveraging technology for market analysis are effective risk management strategies.